Breaking It Down: Investment & The Candlestick Bang Bang! ✨

- Stock Bae

- Oct 26, 2023

- 3 min read

Updated: Jun 11

Fun Fact #1: You, Me, and the Candlestick Band! 🧠🎉

Do you think candlestick patterns are a brain twister? Newsflash: If you can spot patterns in your favorite TV series plot twists, you've got what it takes to dance with candlesticks. Bullish, bearish, doji – these aren't just fancy jargon but stories of the market. They capture the drama, the highs, the lows, and everything in between in the stock world. And once you get their groove, they're as easy as pie (maybe even as tasty). Below are four to start with:

1. Bullish Engulfing Pattern

Appearance:

A two-candlestick pattern.

On the first day, there's a short red (or black) candlestick, which is completely engulfed by a larger green (or white) candlestick on the second day.

What It Signifies:

The pattern often indicates a potential bullish reversal, suggesting that the bulls have taken control from the bears.

It usually forms after a downtrend or during a pullback within an uptrend.

Possible Trading Strategy:

Consider buying at the close of the bullish engulfing candle, especially if it's supported by other technical indicators or increasing volume.

2. Bearish Engulfing Pattern

Appearance:

Another two-candlestick pattern but the opposite of the bullish engulfing.

The first day features a short green (or white) candlestick, which is completely engulfed by a larger red (or black) candlestick on the second day.

What It Signifies:

This pattern suggests a potential bearish reversal, indicating that the bears might have overcome the bulls.

It's often spotted at the end of an uptrend or during a bounce within a downtrend.

Possible Trading Strategy:

Consider selling or shorting at the close of the bearish engulfing candle, especially if other technical indicators or volume trends support this bearish outlook.

3. Doji

Appearance:

A single candlestick pattern where the open and close prices are very close or the same, resulting in a small body. The shadows (lines above and below the body) can vary in length.

What It Signifies:

A Doji represents indecision in the market, suggesting that neither the bulls nor the bears have gained control.

It can indicate a potential reversal or a continuation, depending on the preceding trend and subsequent candles.

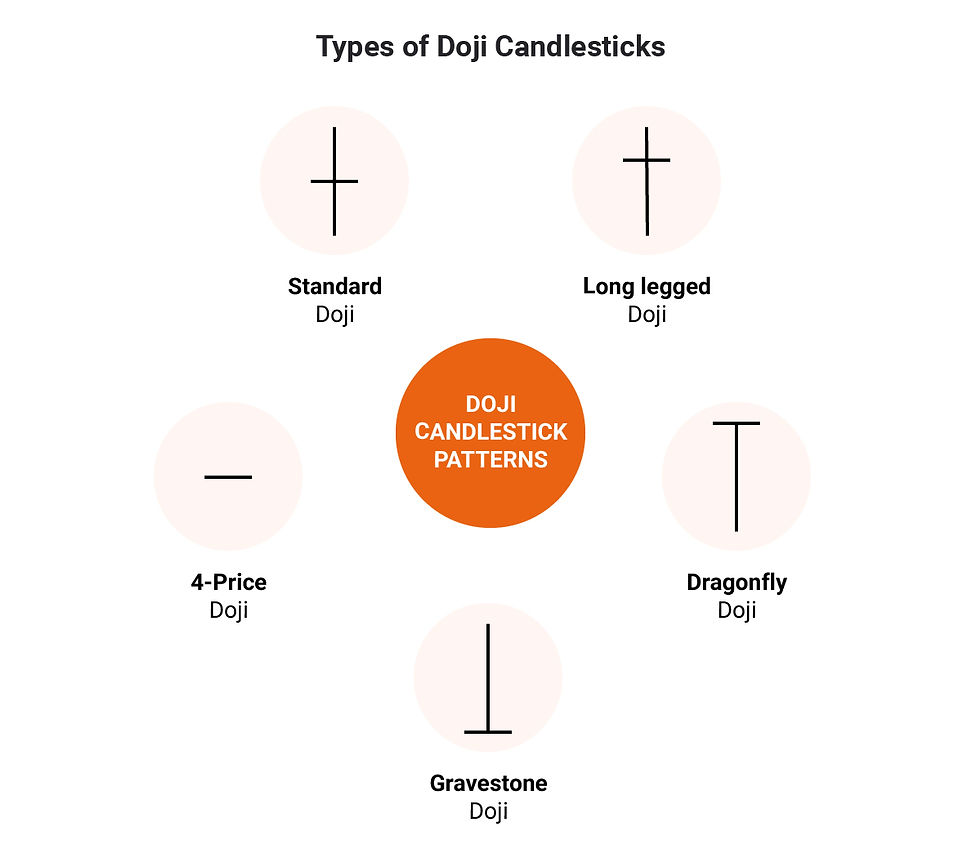

Types of Doji:

Standard Doji: Shadows are relatively equal in length.

Long-Legged Doji: Features long shadows, indicating a greater amount of indecision.

Dragonfly Doji: Open, close, and high prices are the same with a long lower shadow.

Gravestone Doji: Open, close, and low prices are the same with a long upper shadow.

Possible Trading Strategy:

On its own, a Doji might not be a strong signal to trade. It's essential to consider the context of the preceding trend and look for confirmation with the next candle or other technical indicators.

These patterns, while valuable, should be used in conjunction with other technical analysis tools and indicators to validate signals and make more informed trading decisions.

Fantastic Fact #2: Investing: Heart's Desires vs. Brainy Acquisitions! 🍔💹

Sure, those sneakers might be lit, but does their stock have the same sparkle? While love can be blind, investment demands 20/20 vision. Peek behind the brand curtain:

Are they making bank or just baking cookies?

Got a unique dance in their industry?

Tumbling from their peak or climbing?

How's the buzz in the stock chatter jungle?

Fun Fact #3: Gut Feels & Strategy Heels! 🎮🧐

Your gut might nail the Friday night takeaway choice, but trading? That's where you need a magnifying glass, Sherlock. Strategy and research are the unsung heroes. Equip yourself with a treasure map (read: solid strategy) before you embark on your trading adventure.

Fun Fact #4: Perfect Pitch? Nah, It's the Groove That Counts! 🎻📉

Flawless investors? That's a unicorn myth. Trading is more of a dance – a few missteps, a stumble here or there, but then you find your rhythm and groove. Win some, learn tons – that's the mantra. My Stock Bae fam, be curious and embrace the candlestick dance. Let’s chart our way to investment stardom! Stay radiant! 💫

Comments